At Ledyard, we manage a variety of different types of portfolios. We have managed sustainable investment strategies for more than ten years. Please refer to the overview of the topic in our November 2023 Investment Thoughts, “Sustainable Investing Today”. Sustainable minded investors align their portfolios with their personal values. Our objective is to select investments that provide the best balance between financial return and sustainable impact.

There has been recent polarizing media coverage of the sustainable investment field and we recognize that this can be confusing. Some reports were positive and noted the growing popularity of this approach. Others highlighted certain marketing practices and political debate on the topic. To help you put this news into perspective, I will review some of the recent headlines and share our thoughts.

Growing Pains

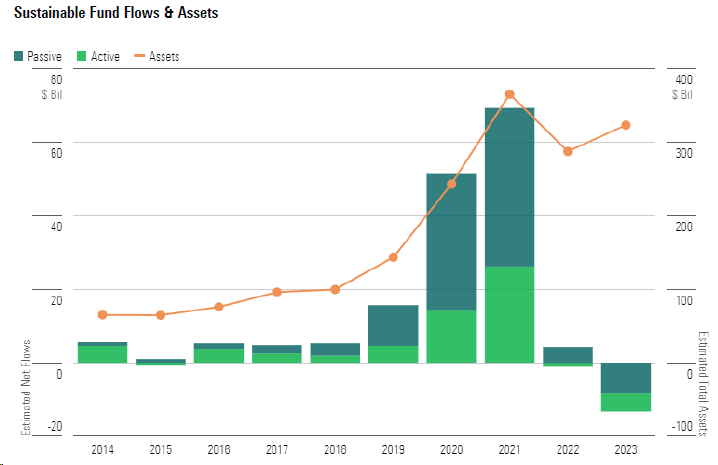

Sustainable investing has been around for decades and became a burgeoning field in 2019. The growth in this category attracted significant industry and media attention. The chart below shows green bars representing investor cash flows into U.S.-based sustainable funds over the past ten years. In 2021, the influx of capital exceeded $69 billion! Yet, that stream of capital turned into a trickle in 2022. Then, in 2023, investors withdrew $13 billion in assets from these funds. The orange line in the chart represents the growth of assets under management in this category. Sustainable funds grew to a peak of $358 billion in 2021, before falling to $286 billion in 2022. In 2023, assets appreciated to reach $323 billion. These facts may lead investors to wonder “what changed?”

Morningstar, “Sustainable Funds U.S. Landscape 2023 in Review

As the growth trajectory steepened, both investment managers and media outlets took notice. Stories about environmental, social, and governance (“ESG”) issues became headline news. Asset managers began ramping up their offerings to profit from the trend. In 2023, sixty-six new sustainable funds launched in the marketplace. Also, there were nineteen existing funds which were ‘repurposed’. Old funds transformed from their prior investment strategy to become sustainable investment funds. Everyone seemed to want a piece of the action.

Clouds Gather

Some of the new entrants into the marketplace were not devoted to sustainable investing. Soon, questions arose about the authenticity of some investment funds. Allegations of “green-washing” were rampant in the media. The term describes making misleading or deceptive statements to present an environmentally responsible image. This led regulators to begin investigations. In some cases, fund managers paid fines and revamped their marketing materials. In the aftermath, regulators tightened the rules to improve disclosures and to increase transparency. The question of authenticity may have contributed to the pullback in new investments to sustainable funds. We prefer dedicated sustainable managers. These are long-standing practitioners of sustainable investing, with solid reputations, and extensive research capabilities. At Ledyard, it’s our duty to identify the firms that are truly dedicated practitioners for the benefit of our clients.

Technology has boosted the ability to review and rate corporations based on their environmental, social, and governance practices. However, this has also led to some ambiguity. As different technology companies began scoring ESG risks, they developed different methods. Two rating firms could evaluate the same corporation but come up with different overall scores. Or they could differ on the weighting assigned to environmental, social, or governance ratings. This may lead investors to wonder who they can trust. Data providers are enhancing their methods. They may converge on an industry standard rating process for ESG practices. The current situation highlights the need for additional oversight. We seek to partner with firms that do their own, in- house research rather than simply relying of ESG data providers.

Macroeconomics have played a role in the perception of sustainable investing. Many of these strategies reduce or eliminate exposure to the fossil fuel industry due to its environmental impact. For this reason, many sustainable funds will look better when the traditional energy sector falters. During the pandemic, the global economy went into lockdown. There was a significant decrease in the demand for fossil fuel. Stocks in the traditional energy sector fell and dragged down broad indices. However, this trend reversed during the various phases of economic reopening. As travel, construction, and office work resumed there was pent-up demand for fossil fuels. In 2022, the energy sector was the best-performing component of the S&P 500 Index, increasing by 63%. Since sustainable portfolios shy away from traditional energy exposure, performance may lag other investments when oil prices rise. Sometimes, exposure to renewable energy can pose a headwind. The energy landscape is evolving rapidly, with a growing global focus on renewable and clean energy sources. While short-term market fluctuations are normal, the long-term trend toward a more sustainable future remains strong. We help our clients guard against bias regarding recent events and adhere to their investment objectives.

Policymakers added to the uncertainty. For example, in the U.S., the Department of Labor (DOL) reversed course within several years’ time regarding how corporate fiduciaries could select investments for 401(k) plan participants.

- 2020: The DOL updated the rules to require corporate decision-makers to consider only those factors expected to significantly affect the financial risk or return of an investment. In other words, ESG risks could not be part of the decision-making process.

- 2021: The DOL announced that they would not enforce those rules. They reconsidered how to better recognize the impact of climate change and other ESG risks when selecting retirement plan investments.

- 2022: The DOL issued a new rule to clarify that corporate decision-makers could consider ESG risks and climate change in their analysis of funds for their retirement plans. In 2023, a federal judge sided with the DOL to support the legitimacy of this rule.

The shifting sands of the regulatory process added confusion to the mix before reaching resolution. Regulations form the backdrop for decisions involving corporate governance for 401(k) plans. These fiduciaries are responsible for making decisions on behalf of the employees as a group. However, these rules don’t apply to individual investors who might choose to invest in a sustainable manner.

The acronym “ESG” became heavily politicized. Sustainable research may lead to the exclusion of certain industries from investment. This practice could be perceived as a threat to jobs in traditional industries. This might include nuclear energy, fossil fuels, tobacco products, or the manufacturing of civilian firearms. There was a fear that voters would be negatively affected by the sustainability trend and divestment movement. The prominence of these headlines may have created confusion for some investors.

The Way Forward

Despite the clamor of outside voices, when it comes to your values and your portfolio, the only decision-makers that matter are you and your family members. No client should be swayed or dissuaded by politicians or the media from investing consistent with their own personal values. Our knowledgeable portfolio managers can help you sort through these issues and gain peace of mind.

We believe that ESG data helps to round out our investment analysis. Our task is to search the universe for the most compelling mix of investments for these portfolios. At Ledyard, we have long experience and deep expertise in the field of sustainable investing. If you have any questions about our investment strategy or your portfolios, please don’t hesitate to reach out to me or your portfolio manager.

Jeff Gendron, CAIA, CEPA, Chartered SRI Counselor™

Jeff Gendron, CAIA, CEPA, Chartered SRI Counselor™

Senior Portfolio Manager and Investment Strategist

jeff.gendron@ledyard.bank