Socially responsible investing has adopted a label that is being used globally: ESG. Some of our clients are experts on certain sustainability themes and others may be less familiar with the concept of values-based investing. This article will offer an introduction, describe our ESG strategies and consider future trends. Along the way we hope to demonstrate the value of integrating life goals, investing and financial planning.

What is ESG?

ESG refers to environmental, social and governance factors used in categorizing and measuring companies. The investment industry is signaling that this form of investing has become more sophisticated and disciplined. Some examples:

ESG Can Be Powerful and Personal

At least one of these categories likely resonates with you. Excluding a company or a sector from your portfolios can be a powerful statement since capital is the lifeblood of companies. Dwindling stock prices and lukewarm bond offerings send a message. Your capital can also help produce important societal outcomes, such as a greater number of women in corporate boards.

Some people disconnect from their investment portfolios because there are too many companies or funds to understand. ESG changes that in a very fundamental way. It allows for a personal connection to one's capital.

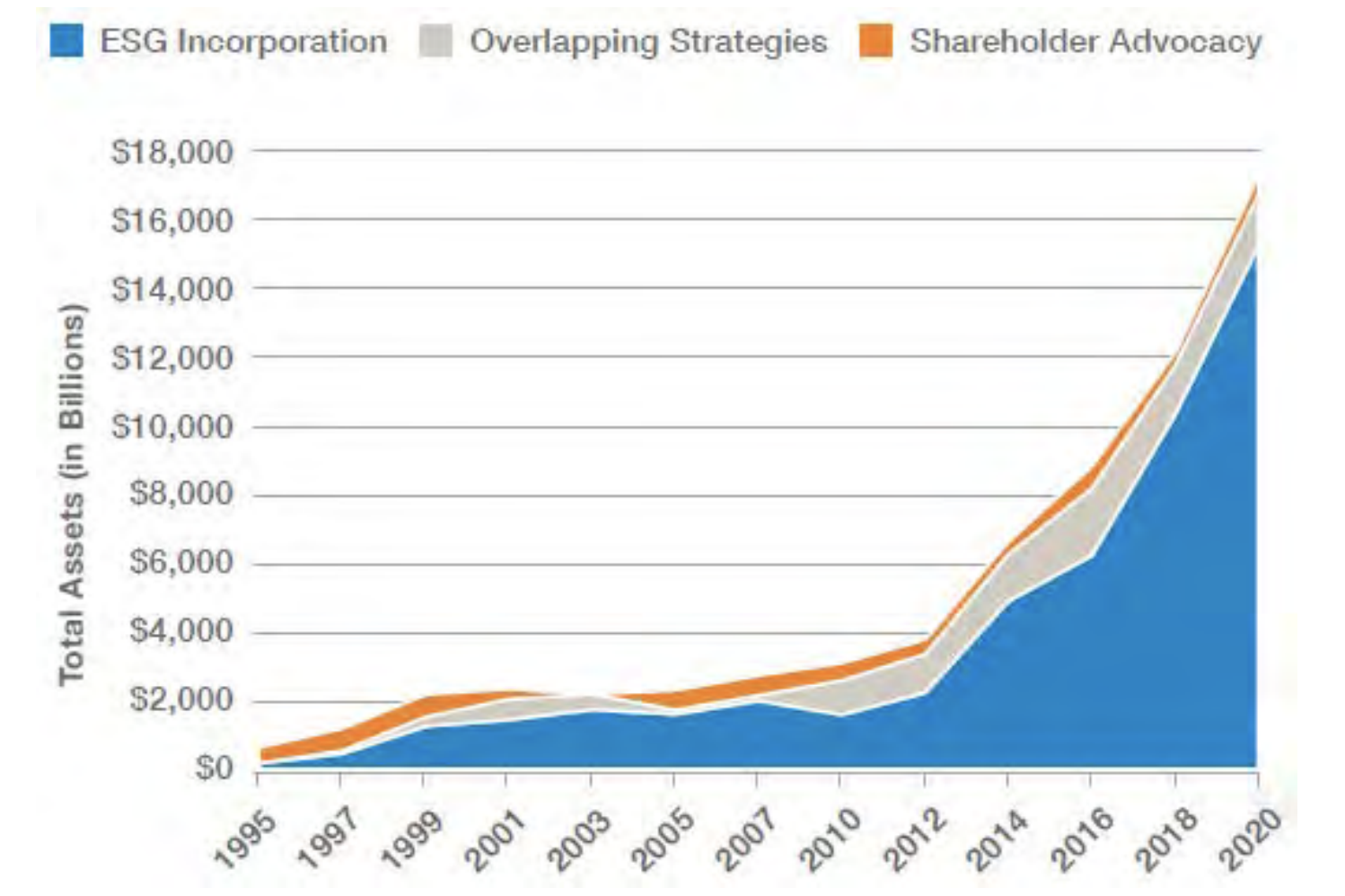

The chart below shows assets under management in the US that are dedicated to ESG investing. Green bonds are also in high demand. The combination of social good with financial results is working. ESG is more than a niche.

Source: US SIF The Forum for Sustainable and Responsible Investment

ESG Scores and Standards

Many providers generate ESG scores on companies globally. The scores vary among providers because there are many ways to interpret data. Measuring the carbon footprint of a company is admirable but challenging. Pollution effects on health are subject to interpretation. Consistency and comparability are still goals.

Academic studies are mixed in demonstrating the profitability of ESG investing.Recent results are positive but there are no guarantees. Several studies have shown that, at the very least, ESG investing reduces earnings volatility. This concept of risk reduction is appearing in bank loans to corporations that embed interest rate adjustments as sustainability goals are met.

As the ESG data industry matures there has been some harmonization of scores and progress toward global standards. Fundamental investment knowledge and experience are still essential as ESG data becomes more useful.

Levels of ESG

At Ledyard we are integrating ESG factors into all of our investment strategies. We view ESG as a useful risk management tool providing a longer range perspective on companies. This fits well with our multi-generational wealth management philosophy.

We have been applying exclusions, such as tobacco stocks, by our choice or client request for over a decade. We have also been managing active ESG portfolios for over seven years and a key tenet has been to focus on financial potential first and then add the ESG perspective. Our initial ESG strategy has been a hybrid of mostly stocks and some funds. We are pleased to announce the launch of a second strategy that we call Open Architecture ESG. While remaining diversified via funds our new strategy will also cover important themes like gender diversity, water treatment and alternative energy. This fund-only strategy can be applied to large or small accounts.

Careful financial planning is integral to ESG investing especially for those relying on income from their portfolios. ESG stock investments can be less income-oriented because some companies reinvest their earnings rather than paying dividends. Some clients have a financial plan that allows them to be fully committed to ESG. For others an IRA or a portion of their investment accounts has been more appropriate.

Diversification of themes and industries is important so ESG portfolios can deliver on long term goals for investors.

Looking Ahead

The Covid shock waves demonstrated a lack of sustainability thinking among countries, government policies and healthcare systems. Many companies will have to change their employee health and safety policies. Supply chain management will also need to incorporate alternative systems and sources. Sadly, there may be another version of Covid in the future and we all need to be prepared.

Every day is Earth Day. The 2015 Paris Climate Agreement signatories committed to reducing global temperatures to within 1.5 - 2 degrees celcius of pre-industrial levels. The effects of missing these targets include flooding of major cities, farmland destruction and more destructive fires and storms globally. According to science journal Nature, over 100 countries and 800 cities have committed or are considering net zero greenhouse gas emissions goals.

Pension plans, endowments and other large pools of capital will continue to divest from coal and other industries that are not aligned with addressing climate change.In the US there are proposals to allow retirement plans to offer ESG investment choices. This will unleash an even bigger wave of change.

Corporate sustainability disclosures have been voluntary but it is likely that there will be mandates for transparency and accuracy. Women represent over 20% of corporate boards of directors. California followed several European countries in mandating the participation of women in boards. Entire countries have scheduled the replacement of gasoline cars with electric cars. Legally mandated ESG changes will continue.

Greenwashing refers to ESG patinas and promises with no substance. In contrast, companies that adopt ESG as a core strategy, make it part of their culture and report outcomes consistently will gain the attention of investors. Data quality will improve and it will increasingly be oriented toward materiality.

Shareholder advocacy and proxy voting are gaining influence. The larger amounts of capital dedicated to ESG mean that more votes are being applied to key ESG issues and company boards and management ignore this trend at their own peril. Management compensation will more often be linked to sustainability progress.

The development of ESG-related projects, policies and laws to stabilize and improve society will continue for decades, as will the need for capital.

Your Legacy

How will you be remembered? The past year made this topic very real for many of us.

My teen daughters gained and lost as a result of Covid. They gained an appreciation for the evanescence of life and the importance of making values-based decisions for the long run. They gained a measure of discipline and toughness. They now viscerally understand how interconnected we are in this world.

However, their social and athletic skills languished. The roots of safety, from which imagination and courage blossom, were weakened. Yet younger generations are resetting their moral compasses and the old ways of doing things will not continue - change is coming.

As Covid begins to relax its cruel grip on humanity my heart aches for those lost and those that can no longer hug loved ones. One thought has stayed with me since last year: “What if I was gone tomorrow?” Would my daughters have good memories of me? What would be my legacy to them and to the world?

Conversations about legacy are like speaking on hallowed ground. Some people focus on family, others on charity. Retirement planning is foundational. Peace of mind and a sense of fulfillment are essential. For our ESG clients: thank you for your encouragement and thoughtful feedback. ESG investing, combined with comprehensive financial planning, is a way to establish a legacy beginning today, rather than in the distant future, and can help transform the world for the better.

I welcome your comments. Thank you.

Best regards,

Fred Wainwright

Fred Wainwright

Fred Wainwright

Senior Vice President

Senior Investment Strategist and Head of U.S. Equities

fred.wainwright@ledyardbank.com

This communication is intended to be strictly informational. Exclusive of our client relationships, it is not intended to be, nor does it constitute an offer to sell or a solicitation of an offer to buy any securities referenced. Information contained herein has been obtained from sources that are believed to be reliable, but its accuracy and completeness cannot be warranted or guaranteed.

Non-deposit investment products are not insured by the FDIC, are not deposit or other obligations of, or guaranteed by the bank or any affiliate, and are subject to investment risk including the possible loss of principle amount invested.

Ledyard National Bank. All rights reserved.