What a year it has been! We have been riding an emotional roller coaster brought on by a historic pandemic. We have worried about the health of our families and friends. The economy and stock market experienced frightening declines followed by partial or full recoveries. Social distancing forced us to alter our behaviors and routines. The virus has put us through the wringer. But even the COVID cloud has silver linings. For me, long hikes and conversations with friends around fire pits have brought renewed appreciation for what I would have otherwise taken for granted. Events like these also produce attractive investment opportunities for those with a long‐term perspective. Better days will come, and the economy will eventually reopen more broadly. When this happens, we believe the value style of investing will regain some of the prominence it lost over the past dozen years. By adding more of these investments to portfolios we hope to enhance your returns.

The value style of investing is all about frugality. Value investors seek stocks that are inexpensive and do not reflect their intrinsic worth. Like shoppers at Costco or TJ Maxx, they hunt for bargains on good quality brands. By contrast, growth investors seek companies that will increase earnings fast. They want the best and are willing to pay a premium.

Since 1926, the value style of investing has beaten the growth style by an average of 1.6 percentage points per year according to BCA Research. The secret of success for value investors seems to be the same as happiness ‐‐ low expectations. Investors tend to overreact to good or bad news and predict it will continue too far into the future. This sets up surprises that move stocks. Value stocks are inexpensive because investors do not foresee as much from them. When these companies beat expectations, their stock can rise. Conversely, growth stock forecasts can become too rosy. When they do not deliver, their stocks can fall sharply.

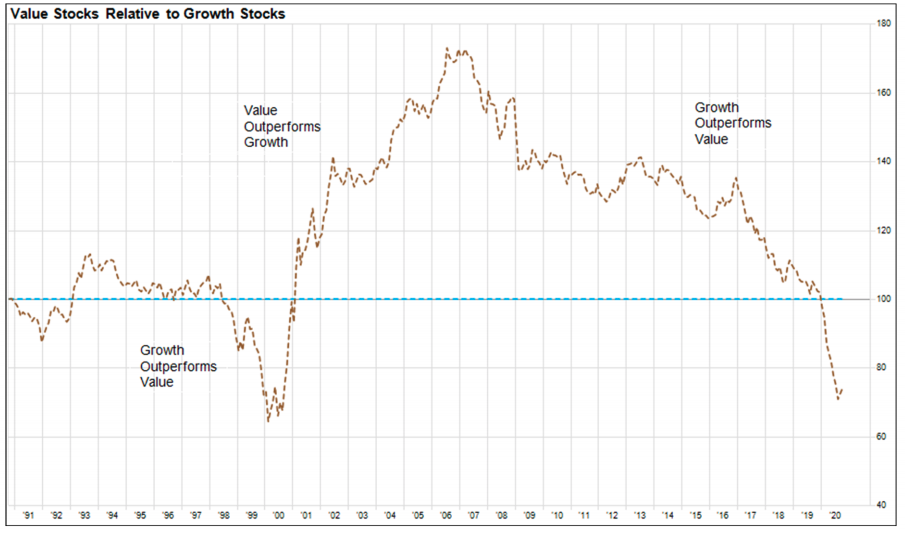

The following chart compares the performance of the Russell 1000 Value Index to the Russell 1000 Growth Index. It shows that growth stocks have performed significantly better than value stocks since 2007. Value stocks have not lagged this much since the late 1990s during the dot‐com and technology bubble. After the bubble popped, value stocks gained 70% over the next seven years while growth stocks dropped over 30%.

Source: Factset

Today, the FANMAG stocks (Facebook, Apple, Netflix, Microsoft, Amazon and Google) are driving the Russell Growth Index. They are excellent companies with captivating stories. As a group, their stock prices have surged about 45% year‐to‐date. Investors see these businesses as COVID‐proof. They now account for 40% of the growth index. Remarkably, their market cap is almost equal to the developed markets of Europe. The robust performance of these stocks is a key reason why the valuation gap between growth and value stocks is historically wide. The price‐to‐earnings ratio for the growth index is 31 versus 17 for the value index.

The discount in value stocks belie the fact that there are many high‐quality companies in this category. The largest value stocks in the Russell Value Index are Berkshire Hathaway, Johnson & Johnson, JP Morgan, Verizon, Disney and Intel. They are admirable companies. They have strong market positions and durable competitive advantages. But here is the rub. Many of them are sensitive to changes in the economy. The expansion that followed the Financial Crisis of 2007‐2008 was very long but weak. It ended with a COVID-induced 30% drop in the economy. Unsurprisingly, investors have been more comfortable owning growth stocks. Their fortunes are less reliant on the economy.

Valuation gaps this wide do not last. Virus cases are rising, which could hinder the economy in the near‐term. However, it is not too early to think about a time when the economy can fully reopen. This will lead to a period of above average growth that should help the relative performance of value stocks. Many vaccines and therapies are under development. They will lessen the impact of this nasty virus. The Federal Reserve has taken strong steps to boost economic growth. Congress will eventually approve another fiscal stimulus bill. Better economic growth and modestly higher interest rates would help financial and industrial stocks. These are two of the largest value sectors.

We build diversified portfolios for our clients. This helps reduce risk because market factors often behave differently from each other. Just as we diversify across asset classes, regions and sectors, it makes sense to hold both growth and value stocks. Like all investors, we do not have a crystal ball to tell us exactly what the future brings. But we can rely on past relationships to guide us. History suggests that it is sensible to tilt toward high‐quality value investments. As part of this process, we are paring back some growth stocks that have become expensive and too large. This is always hard to do. After such a strong run they seem indomitable. But we know from history that the leaders in any one decade often lag in the next.

Some investors believe the value style will never work again. That often happens before the tide turns. We are confident it will because value investing has an edge that is rooted in human behavior. While investors may become smarter each year, human nature does not change. Value investing is about discipline, patience and the ability to question the popular narrative. Those traits do not come naturally. As the great value investor Bernie Horn put it, “Human nature is a key factor in stocks being mispriced, I wouldn’t expect that to change anytime soon.” We agree and believe it will be helpful to have some of these investments in your portfolios.

Please do not hesitate to contact us if you need anything or would like to discuss your portfolios in more detail.

Douglas B. Phillips, CFA

Douglas B. Phillips, CFA

Chief Investment Officer

douglas.phillips@ledyardbank.com

This communication is intended to be strictly informational. Exclusive of our client relationships, it is not intended to be, nor does it constitute an offer to sell or a solicitation of an offer to buy any securities referenced. Information contained herein has been obtained from sources that are believed to be reliable, but its accuracy and completeness cannot be warranted or guaranteed.

Non-deposit investment products are not insured by the FDIC, are not deposit or other obligations of, or guaranteed by the bank or any affiliate, and are subject to investment risk including the possible loss of principle amount invested.

Ledyard National Bank. All rights reserved.